Market Update - January 2024

/ReColorado and DMAR released market stats for January 2024. The big buzz in the industry is that mortgage rates dropped to ~6.7% in early January from a high of 7.8% in October, which drove a spike in buyer activity. Mortgage applications increased 39% above October lows due to lower interest rates and seasonality.

Showing traffic, offers, and pending contracts on detached single family homes priced under $600,000 picked up drastically in mid-January for houses that had been sitting on the market over the holidays and many new listings received multiple offers.

Anecdotally, we felt a noticeable pick-up in buyer activity. Tara had some buyers looking all over Aurora around $650k in Mid-January and one Saturday she showed them 6 houses, 3 of which already had multiple offers in the first 3 days on market. One of the home inspectors we partner with said that the third week of January was the busiest week he’d had since June.

Houses that are priced well, clean, staged, and nicely updated are getting offers quickly. There appears to still be a bit of a disconnect with sellers on pricing their homes, as listings that hit the market that are overpriced even by only $10k-$20k will sit for weeks.

The Stats

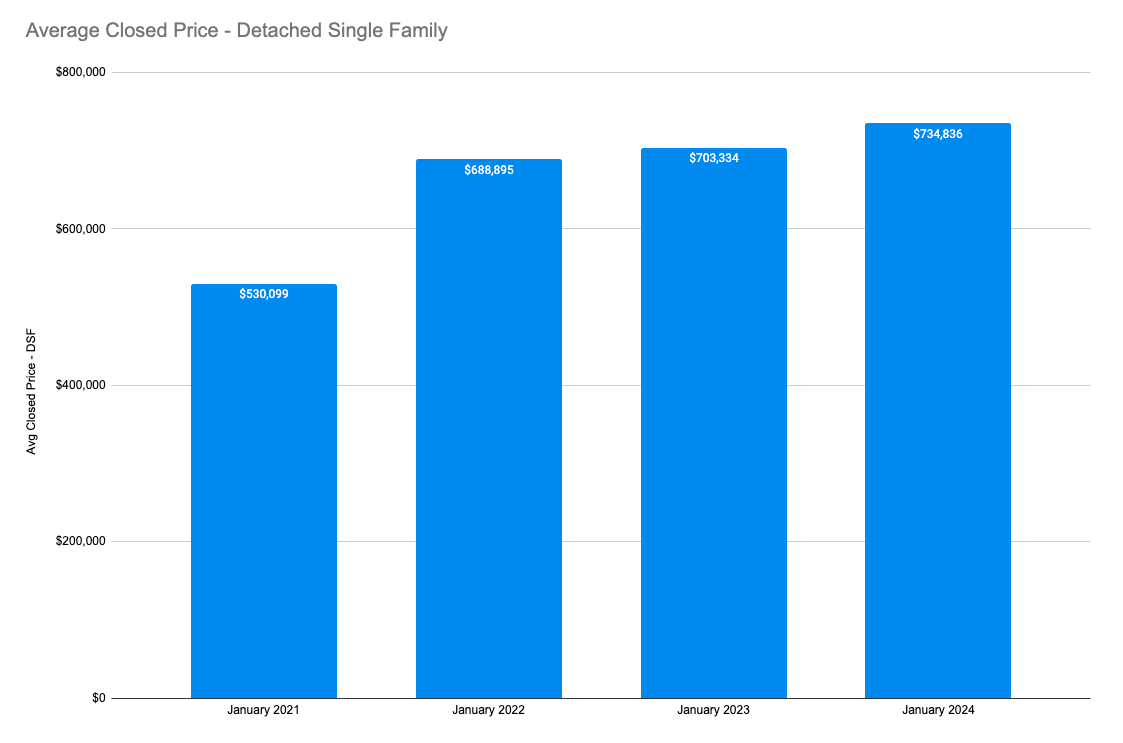

Average closed price for detached single family homes in Denver Metro was $734,836 which is a 4.48% increase over January 2023.

New listings were up 14.73% YoY in January but still down 22.48% from January 2021 numbers

Average Days on Market was 50 for Detached Single Family homes in January, up 2.04% YoY but up 163.16% from 2022 averages

The average number of active listings in January from 1985 - 2023 was 12,215. January 2024 had 4,871 active listings, well below that average

Flippers and developers are having a bad time. Higher mortgage rates paired with labor constraints and long waits for building permits has made flipping less appealing and many flippers are exiting the market. It has also made investment properties less lucrative.

Close-Price-to-List Price Ratio

One metric that we keep a close eye on is the close-price-to-list-price ratio. This metric is basically a proxy for the existence of bidding wars in the market. A value of 100% means that on average listings closed at their asking price, anything above 100% indicates that listings closed for over their asking price and likely had multiple offers, while a value below 100% indicates that offers were below asking price.

In January 2024 the closed-price-to-list-price ratio was 98.34% meaning that on average listings closed 1.66% below their asking price which translates to roughly $12,200 below list price on average. For reference, this ratio was 102.19% in 2022 when there were bidding wars happening all over the place.

Local Topics

The Colorado House introduced a bill that will classify any property used as a short-term rental for more than 90 days a year as a commercial property from a taxation perspective, increasing the tax rate from 6.8% to 29%. Mountain communities are up-in-arms over this proposal and it has been hotly contested by short-term rental owners and property managers alike. If it passes we’re guessing a bunch of urban STRs will be converted to long-term rentals and it may even drive an increase in listings hitting the market.

Property tax valuations went out after the big increases in assessed property values in 2023. Colorado has launched a program to the general public with the goal of helping offset some of these higher tax bills for property owners. Homeowners who experienced an increase in property taxes of more than 4% over the last two years may defer some of the annual payment up to $10,000. Here is a link to more information on the program.

Xcel Energy in all their greedy glory wants Colorado residents to pay them more money to offset their costs on improvements for both gas distribution and the electric grid. They are proposing a rate hike on natural gas that has nothing to do with the cost of natural gas and everything to do with improving their infrastructure. Yeah, you read that right. Xcel Energy made $8.347B (as in Billion with a B) in profits in 2023 and they think YOU need to pay them 7.4% - 10% more on your already high utility bill to improve THEIR infrastructure. Pretty outrageous, right? The Public Utilities Commission has to approve the rate hikes, you can submit a formal complaint to the PUC here and if you want some content for the complaint to paste right in place this reddit thread has some good suggestions.

Speaking of Xcel Energy, they are facing nearly 300 lawsuits for their role in starting the Marshall Fire - the worst fire in Colorado history that killed 2 people, destroyed over 1,000 buildings, killed over 1,000 pets trapped inside homes, and displaced over 37,500 people. In June 2023 it was determined that a sparking Xcel power line was one of the contributing causes for the fire. Good thing they make so much money.

There is a migrant crisis unfolding in Denver, which has taken in nearly 40,000 migrants. That’s the most per capita of any city in the nation and it is dramatically straining Denver’s municipal budget. Mayor Mike Johnston has made multiple requests for federal funding from the White House and Congress, which failed to secure funding after a proposed bill was unable to pass. Johnston has since announced up to $5M in cuts to parks and recreation and the DMV. If you’re interested in helping migrants here is a list of ways to do that.