Market Update - July 2024

/If you know anyone who is trying to sell their house right now you have probably heard about how “weird” the market has been. Ever since interest rates increased 2 years ago buyers have been hoping for prices to come down. We hadn’t seen that happen because so many sellers were rate locked into their homes with super low interest rates, so inventory remained incredibly tight and we mostly saw prices stay flat or slightly appreciate year-over-year.

That trend is beginning to change as we are grappling with an influx of listings hitting the market in the Denver metro area (and nationwide) coinciding with what can only be described as buyers collectively deciding they aren’t really in a rush to sign up for a $5,000 monthly mortgage payment.

Swimming in Inventory

Active listings continued to rise in June and we saw the highest level of active inventory that Denver Metro has seen in a decade. New listings for all property types in June were up 35.69% Year-over-Year and up 3.58% above May 2024.

At the end of May when I examined these numbers I noticed that we were not at an all-time inventory high when looking just at Detached Single Family homes, but with the increases we saw in inventory over the last month that trend now applies to all property types.

Months of Inventory

Months of Inventory is a metric we use to look at how long it would take to exhaust the current housing supply if no new listings hit the market. This one is telling, in June we were at 3 months of inventory on the market which is highly abnormal for this time of year and indicates that the market peaked earlier this year than it typically does.

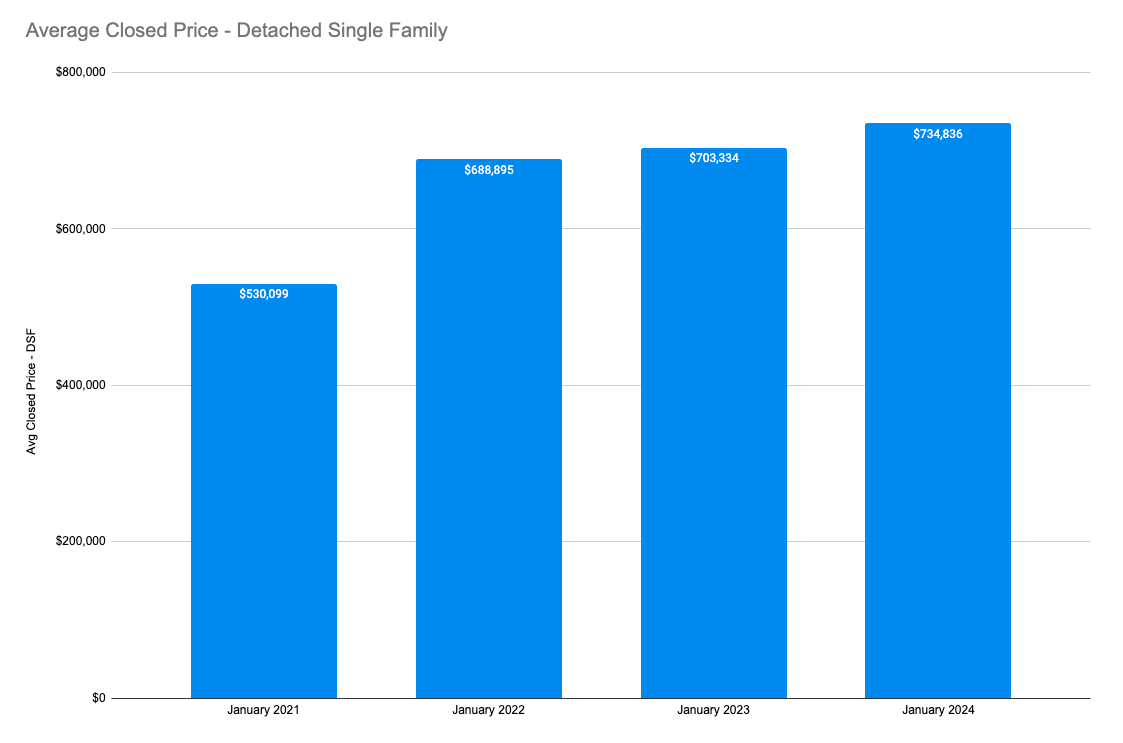

What About Prices?

Median closed price for detached single family homes has stayed relatively flat, it was down 0.29% MoM and up 0.87% YoY but it is clear to see there has been some price depreciation since the heyday of the pandemic. For reference, interest rates started increasing in June of 2022.

Days On Market

Average days on market increased both monthly and year-over-year. As more inventory hits the market I expect this metric will continue to climb upwards through the end of the year.

Market Anecdotes

June was an odd month for buyers and sellers alike. Typically the market peaks in June and then begins its “retraction phase” after the week of Independence Day but this year buyers started behaving apathetically well before then and our open houses and showing traffic has been pretty quiet.

We have noticed a big uptick in vacant and dated properties sitting on the market for months on end. Sellers should consider staging as a tool to maximize showing traffic and ensure that the property looks as good as it possibly can in photos. When we are talking about price reductions of $10,000+ it seems silly not to spend the money up-front on staging. Cohesion Homes now offers staging services for interested sellers.

Now What?

Housing inventory picked up right as buyer activity softened. June is typically one of the busiest months for closings but this year things slowed way down and buyers have been able to enjoy more negotiating power than they’ve had in years. Properties selling over asking price declined, and concessions became the norm. Sellers in this market should price conservatively and expect to pay a closing cost concession to help buyers with their loans.

Transactions falling out of contract has also been notably high, primarily due to inspection issues, the rising cost of insurability, and increased HOA dues. It is crucial for listings to correct major issues and be prepared to negotiate to successfully reach the closing table.

Everyone is hoping for rates to fall, but I believe it is more likely that we will start seeing softness in housing prices for the time being. We saw some slight declines in rates in response to June inflation data being lower than anticipated, but it is still not consistently low enough for the Federal Reserve to justify a rate cut any time soon.